Business Basics 106 – Management and Leadership II

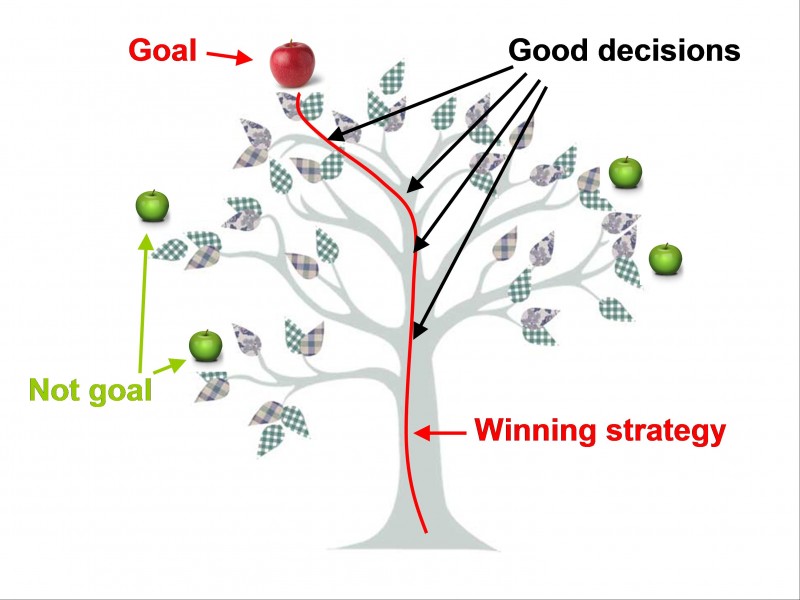

Planning and Decision Making The number one upper management function is planning – setting the…

Business Basics 106 – Management and Leadership

Part 1 – The Manager In the past, managers were called bosses and did their…

A Note from BauerGriffith

We are living in difficult times – the coronavirus pandemic, wildfires, global warming, racism, and…

Business Basics 105 – Starting a Small Business

The Small Business Administration advises that one of the major causes of failure of small…

Business Basics 104

Part 4 – Corporate Expansion A merger is when two companies combine into one, whereas…

Business Basics 104

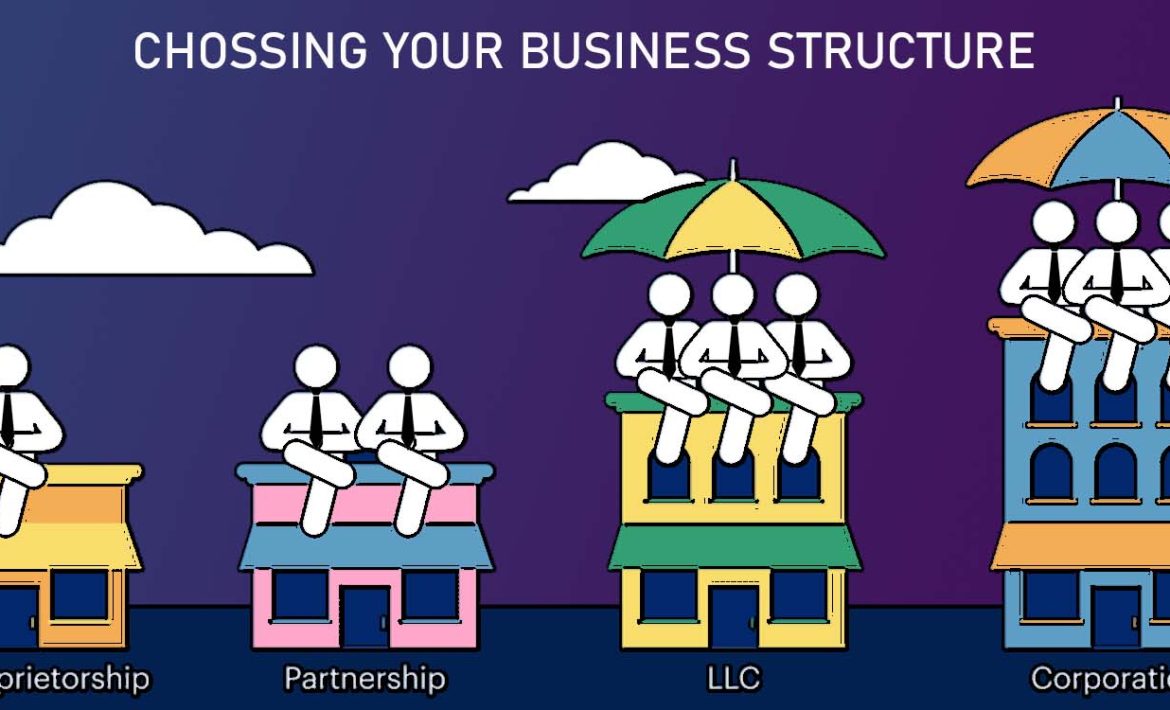

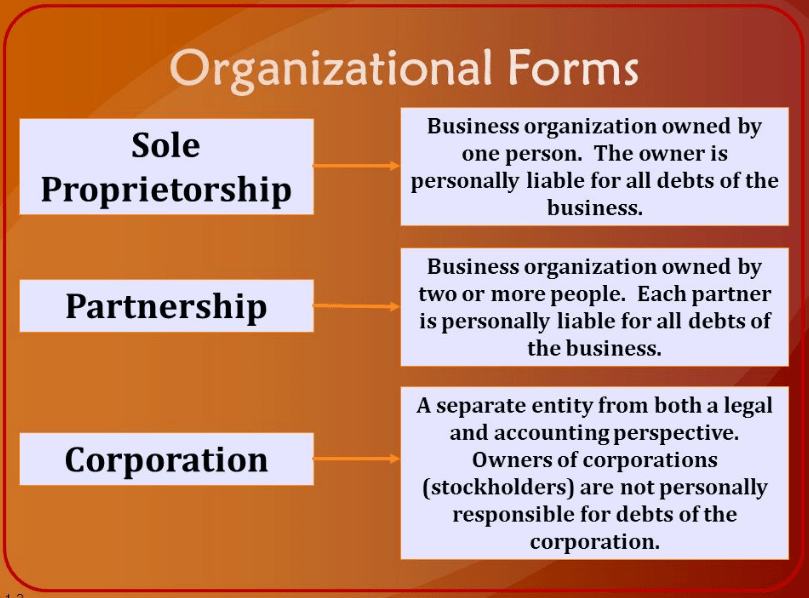

Part 1 – How to Form a Business, Sole Proprietorship and Partnership The form of…

A Guide to Standing Committees for Nonprofits – The Investment Committee

Last week we discussed the role of the Finance Committee for nonprofit organizations. Now we’d…