One of the biggest advantages of running your business as a corporation, limited liability company or other corporate entity is that it provides limited liability to the owners. Stated differently, the owners are shielded from personal liability. However, you must be diligent in maintaining the corporate existence in order to enjoy such protection.

One of the first things I tell business owners is not to treat the company as an extension of themselves. At the top of my list is to avoid paying personal expenses from corporate accounts. Do not write a corporate check to pay a personal expense, do not use a corporate credit card to buy your family’s groceries, do not use your corporate credit card to take your wife to the theater. In addition, if the business owner has multiple businesses, I remind her to keep each corporate entity separate from the others. Do not use one company’s check to pay another company’s expense and so on. Commingling of assets can present similar problems as well.

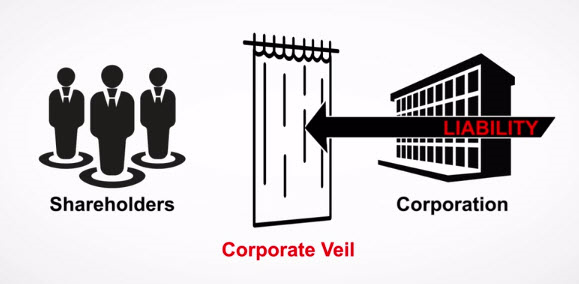

Courts have regularly noted that if the business owner does not respect the corporate existence, an adversary will not be required to either. In these instances, the adversary argues that the company is nothing more than the alter ego of its owners, and courts allow the adversarial party to “pierce the corporate veil” and seek to hold the business owners personally liable.

Respecting the corporate existence also includes keeping proper books and records, minutes of director and shareholder meetings, and having proper agreements in place, to name a

few. Agreements should include those with outside companies, and especially those with the owners or related companies, if applicable.

The law goes far to protect business owners, but it has its limits. It is incumbent upon you to protect yourself and your business.