Business Basics 106 – Management and Leadership II

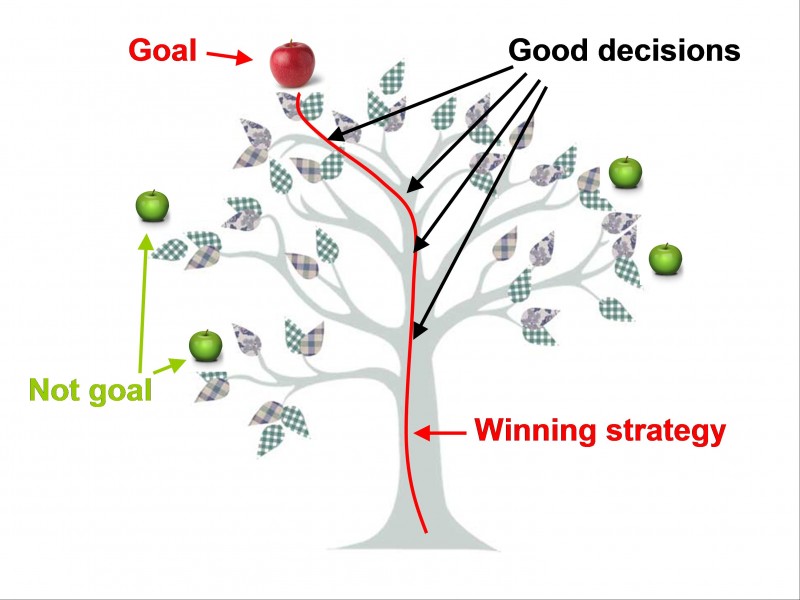

Planning and Decision Making The number one upper management function is planning – setting the…

Business Basics – 101

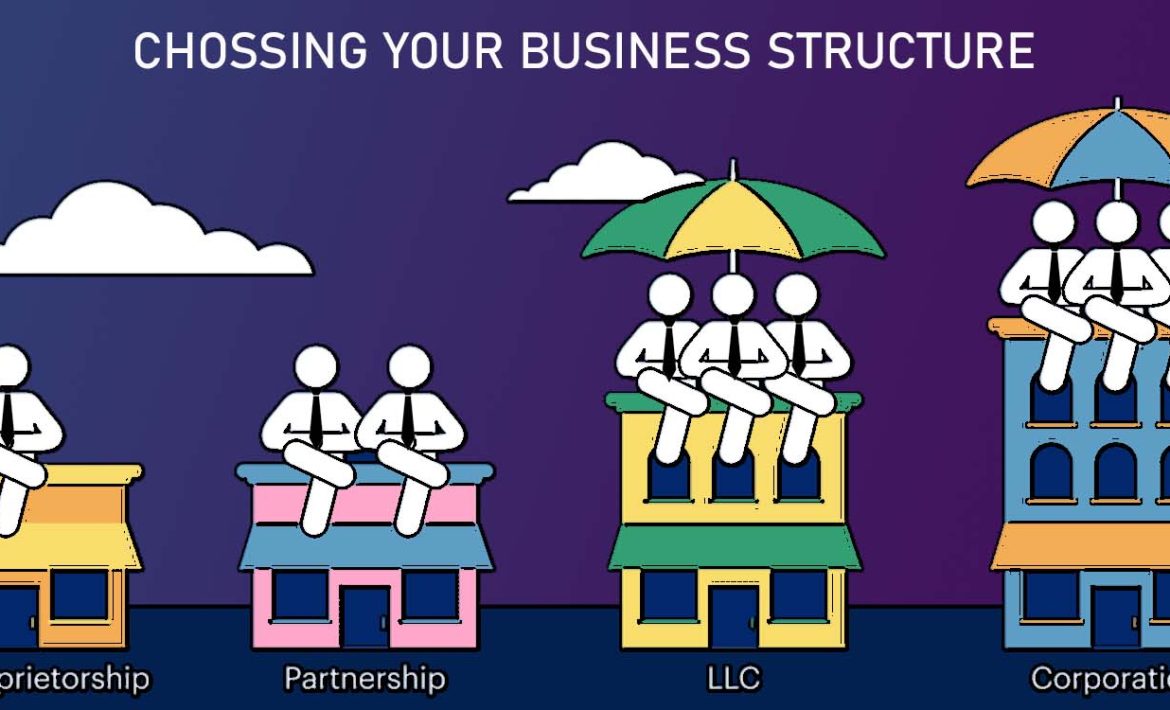

Part 3 – The Importance of Entrepreneurs to the Creation of Wealth There are two…

Why You Need a Great Accountant on Your Business Team

Whether you’re operating a for profit or a nonprofit enterprise, you need a great team…