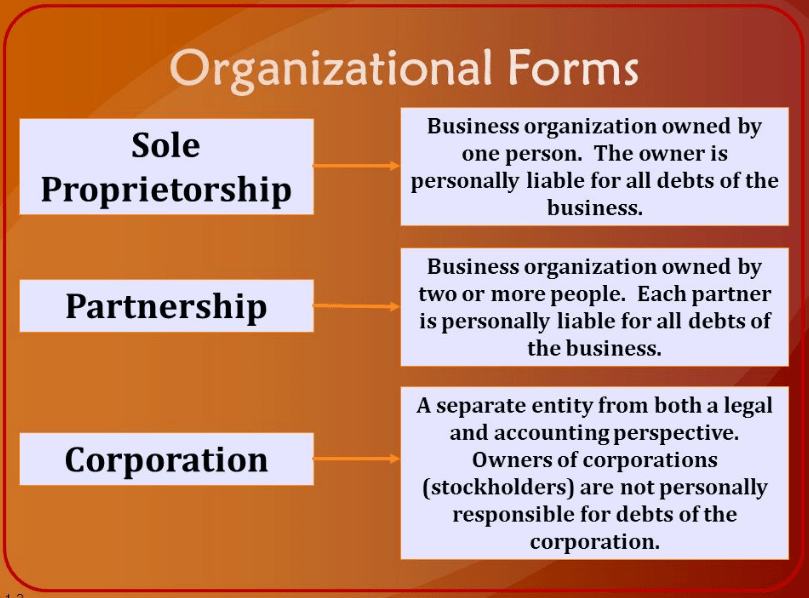

Part 2 – How to Form a Business, Corporations

You don’t have to be a big business to form a corporation. A corporation, sometimes known as a C corp., is chartered with the secretary of state, and is a unique “person” with separate liability from its owners, known as stockholders. The biggest advantage of forming a corporation is that it limits the stockholders’ liability to the amount they’ve invested; they do not have personal liability for the debts or other problems of the company. A corporation also allows multiple people to share in the ownership, and hopefully the profits, of a business without the necessity of working there or other commitments to the company. Corporations choose whether to offer ownership to outside investors or to remain privately held.

As previously stated, a corporation offers limited liability for its owners. Additional advantages include the ability to sell stock to raise money from investors; to borrow money from banks or investors; perpetual life, i.e. the company does not terminate with the death of its owner(s); ease of ownership change; ability to offer stock options to attract valuable employees; and to raise money separate from getting investors involved in management of the business.

The corporate heirarchy, from the top down, begins with the owners/stockholders who elect the board of directors, the board hires officers, the officers set the corporate objectives and hire management, the managers supervise the employees, and the employees perform the functions of the business. Thus the owners help dictate who runs the company, but not its day to day operations.

There are also disadvantages to corporate entities, including the initial set up costs; paperwork, both initially and ongoing; double taxation – first the corporation pays tax on its income before any is distributed to stockholders as dividends, then the stockholders pay income taxes on the dividends they receive; two tax returns, a corporate return and individual return; once started a corporation is hard to end; and finally the potential for conflict between directors and management.

While we are all aware of many large corporations, IBM, AT&T, Apple, many corporations are small business owners who typically do not issue stock to outsiders, focusing more on limited liability and possible tax benefits.

An S corp. is a regular corporation that elects to be taxed like a partnership, thus avoiding double taxation. Profits of an S corp. are taxed only as the personal income of the shareholders. In order to qualify to make this election, the company cannot have more than 100 shareholders, must have shareholders that are individuals or estates, and who are citizens or permanent residents of the United States, must have only one class of stock, and must derive no more than 25% of its income from passive sources. If an S corp. loses its status as such, it must wait five years to make another S election.

Finally, there’s an interesting hybrid known as a limited liability company. This entity does not have the formal requirements of a C corp. and has the tax advantages of an S corp. It offers limited liability to its members; is taxed as a partnership, though it can choose to be taxed as a corporation; does not have the same ownership restrictions as an S corp.; has flexible distribution of profits and losses, which do not have to be distributed in proportion to the money each person invests, but is by agreement of the members; anddoes not have to comply with the ongoing operating requirements of a corporation, such as annual meetings, minutes and written resolutions, though an operating agreement is a good document to put in place.

LLCs have disadvantages as well, including limitations on transferabiity of membership interests; a limited life span, which could be triggered by the death of a member; inability to deduct fringe benefits, thus few incentives available for employees; although less paperwork than a corporation, more than a sole proprietorship; and members must pay self employment taxes on their profits.

Determining the appropriate form for your business typically involves input from both a lawyer and an accountant to ensure you create the best opportunity for you and your company.