Business Basics 108 – Leaders

Sometimes a person can be a good manager but not a good leader, and vice…

Expanding Our Thinking — Noncash Gifts are Key to Fundraising Growth

As fundraisers, we are trained to focus on cash gifts. After all, they are the…

A Window to Gratitude

As we approach the holiday season, many of us are feeling disconnected from the people,…

Business Basics 106 – Management and Leadership II

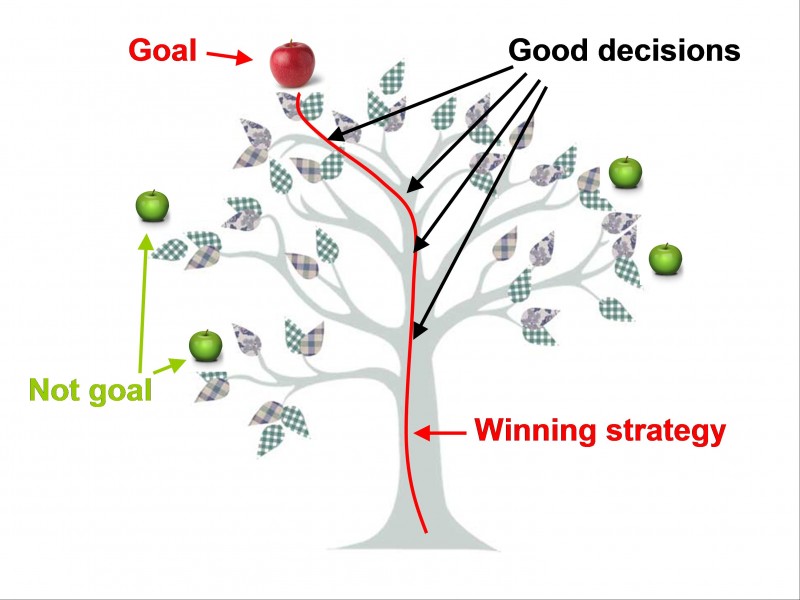

Planning and Decision Making The number one upper management function is planning – setting the…

PPP Loan Forgiveness Update

More details regarding Paycheck Protection Act loan forgiveness emerged from the US Small Business Administration…

New Data – Nonprofits, Benchmark Against Your Peers and Push Your Mission Forward

This week we’d like to share a blog written by the Nonprofit Practice Leaders of…

Business Basics 106 – Management and Leadership

Part 1 – The Manager In the past, managers were called bosses and did their…

Nonprofit Compliance Reporting Checklist

In representing small, mid-size, and even larger nonprofits, we often find the array of periodic…